Is Sourcing Chinese Bamboo Facial Tissue Paper Manufacturers More Cost-Effective Than Local Suppliers?

Profit margins are shrinking. For wholesalers and importers, every dollar saved matters. Sourcing from China might cut costs—but does it still make sense after freight and certification?

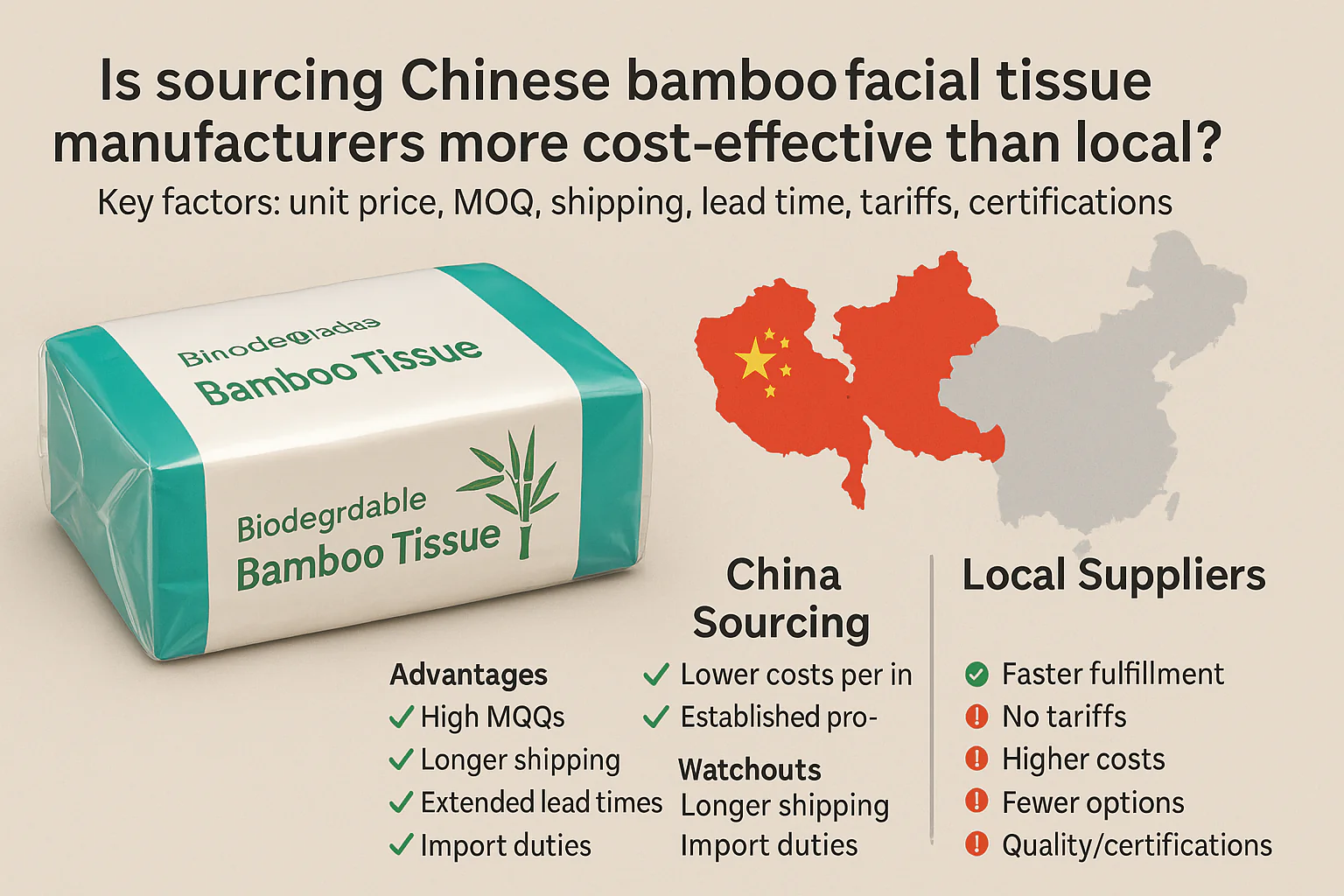

Yes, sourcing from a China bamboo facial tissue paper manufacturer is often more cost-effective due to lower production costs, strong OEM support, and high export capacity. However, importers must factor in shipping, MOQs, and compliance. For bulk buyers, Chinese suppliers typically offer better unit pricing and scalable customization.

Let’s break down cost, logistics, and certification differences so you can decide whether to import eco-friendly tissue from China[^2] or source locally.

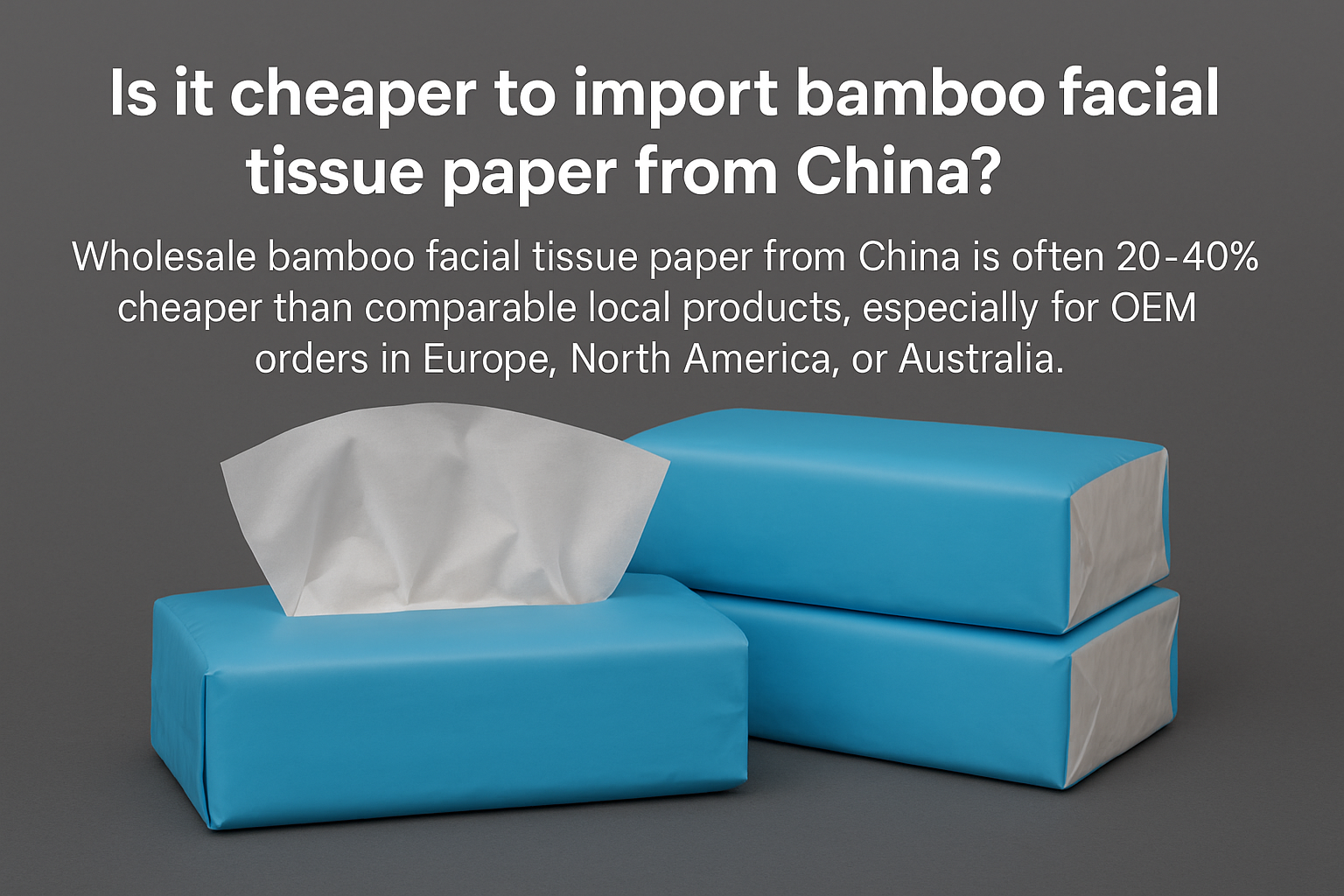

Is it cheaper to import bamboo facial tissue paper from China?

For most wholesalers and private label brands, yes. Chinese factories offer lower unit costs—even after factoring in freight—for orders above 1x20ft container.

Wholesale bamboo facial tissue paper from China is often 20–40% cheaper than comparable local products, especially for OEM orders in Europe, North America, or Australia.

Sample Price Comparison

| Item | Local Supplier (USA/EU) | Chinese OEM Supplier |

|---|---|---|

| 3-ply bamboo toilet paper | $1.10–$1.30/roll | $0.65–$0.85/roll |

| Facial tissue (cube box) | $0.90–$1.15/box | $0.50–$0.70/box |

| 1/8 fold napkins (white) | $0.012–$0.015/pc | $0.006–$0.008/pc |

These prices reflect container-level orders. Smaller orders may see costs offset by freight and duties.

How do Chinese bamboo tissue factories keep costs low?

Chinese tissue factories benefit from a mature supply chain, access to raw bamboo near provinces like Sichuan, and large-scale production capacity.

China bamboo tissue paper manufacturer[^1]s reduce costs through proximity to bamboo plantations, low labor costs, automated production lines, and integrated packaging facilities.

Key Cost Drivers in China

| Factor | Cost Advantage |

|---|---|

| Raw material sourcing | Local virgin bamboo pulp |

| Labor cost per unit | Significantly lower than EU/US |

| In-house packaging | Reduces third-party outsourcing |

| High MOQ/volume | Lowers per-unit overhead |

| State incentives (in some areas) | Support green manufacturing |

Factories offering OEM/ODM also lower branding costs with built-in private label options and multi-language printing services.

Are shipping costs a major concern for importing bamboo paper?

Shipping costs rose sharply after 2021, but they’ve stabilized in most regions. For bulky but light products like tissue, volume—not weight—is the cost driver.

Importing eco-friendly tissue from China adds $0.03–$0.07 per unit depending on carton size, Incoterms, and destination port.

Sample Ocean Freight Estimate (2024–2025)

| Route | Avg. Freight per 40ft HC (USD) |

|---|---|

| China → West Coast USA | $2,000 – $2,800 |

| China → Europe (Rotterdam) | $2,300 – $3,100 |

| China → Australia (Sydney) | $1,800 – $2,400 |

To optimize costs, many buyers bundle multiple SKUs per container and negotiate FOB terms.

What certifications should I look for in a Chinese tissue supplier?

International buyers should confirm both quality and sustainability certifications to avoid clearance issues or brand risk.

Look for ISO, FSC, FDA, and GSO (for the Middle East) when evaluating a China bamboo tissue paper manufacturer[^1].

Common Certifications for Export

| Certification | Region/Use |

|---|---|

| ISO 9001 / 14001 | Global QC & environmental standards |

| FSC | Sustainability & responsible forestry |

| FDA (USA) | Contact safety for tissue & wipes |

| GSO (GCC) | Required for Saudi, UAE, Qatar, etc. |

| SGS Reports | Lab testing for absorbency & hygiene |

Reputable suppliers provide full documentation—including test reports—for retail chains, e-commerce, or wholesale buyers.

How does MOQ and lead time compare with local suppliers?

Chinese manufacturers often require higher initial MOQs, but many offer flexible packaging and consolidated production slots for repeat buyers.

Standard MOQs from Chinese suppliers range from 5,000 to 30,000 units per SKU, with lead times between 20–35 days after design confirmation.

MOQ and Lead Time Snapshot

| Product Type | MOQ (China) | Avg. Lead Time |

|---|---|---|

| Bamboo toilet paper rolls | 10,000 rolls | 25–30 days |

| Facial tissue (cube box) | 5,000 boxes | 20–25 days |

| Napkins (1/4 fold) | 30,000 pcs | 15–20 days |

In contrast, local suppliers may offer lower MOQs—but at 30–50% higher pricing and limited branding flexibility.

Conclusion

For serious volume buyers, China remains competitive. With the right partner, importing bamboo tissue delivers savings, flexibility, and custom branding—if you plan around logistics and compliance.

[^1]: Explore the advantages of sourcing from China, including cost savings and production efficiency.

[^2]: Find out how importing eco-friendly tissue can be both sustainable and economical.

[^3]: Discover why many businesses find wholesale bamboo toilet paper from China to be a cost-effective choice.

[^4]: Learn how to choose the right OEM supplier for quality and cost-effectiveness.

[^5]: Understand the importance of FSC certification for sustainability in tissue manufacturing.

Share this article

About the Author

You might also like

Why Are Bamboo Fibre Tissue Manufacturers with Low MOQs Better Suited for Small and Medium-Sized Wholesalers?

Why Is Demand for Bamboo Fibre Toilet Paper Growing Rapidly in the US Market?

How to Determine Whether a Bamboo Fibre Tissue Manufacturer Possesses Long-Term Supply Capability?

Why Are Soft Pack Facial Tissues Gaining Popularity in Hotels and Restaurants?

How Can Customized Soft Pack Facial Tissues Boost Your Brand’s Image?

What Are the Key Benefits of Using Soft Pack Facial Tissues Over Traditional Boxed Tissues?

Is There a Market Demand for Eco-Friendly Soft Pack Facial Tissues in the Middle East?

What Should Wholesalers Look for in a Reliable Soft Pack Facial Tissue Manufacturer?

Can Soft Pack Facial Tissues Be Customized for Religious and Holiday Events?